Marketing Corner

Simplicity and Life Policy Pros have partnered with Patrick Kelly, author of Tax–Free Retirement, The Retirement Miracle, The Five Retirement Risks, and Stress-Free Retirement. Patrick’s straightforward, easy-to-read books are available to order. In addition, this sales program was designed to educate you and your clients on how the concepts addressed in this series have helped many advisors experience great results.

What’s New?

Some carriers have changed their minimum age, maximum age and maximum death benefit amounts – in some cases up to $3 million – with respect to their accelerated underwriting programs (potentially no exam). Standard and preferred smoker rate classes may also be available. One carrier has reduced their term rates and also reduced the cost of insurance for their GIUL product.

Simplicity has developed a marketing program designed specifically for business owners.

Simplicity has added an interactive presentation that narrows down the focus of how an IUL fits into your client’s retirement portfolio.

Did You Know?

Section 7702 of the IRS tax code addresses rules for a contract to qualify as a life insurance contract per federal income tax purposes. If a policy does not “pass” these rules/tests (basically determined as per the relationship between premiums paid and death benefit) to qualify as life insurance, it may be considered a modified endowment contract, or “MEC” for short. MEC’s do not enjoy as many tax advantages as life insurance.

Recent changes to section 7702 allow a larger amount of premium to fund a policy while maintaining its “life insurance” status. Therefore, if your client is using his or her policy as an investment vehicle, he or she can fund his or her policy more efficiently and buy less life insurance coverage in comparison to the cash value buildup. A higher percentage of the premium goes toward the cash accumulation part of the policy. The death benefit is lower, thus decreasing cost and increasing the rate of return on the premiums your client has contributed. Call us if you would like to discuss this strategy.

Annuity Rate Watch

Many of your clients have money sitting in historically low yielding CD’s and savings accounts. Through our Annuity Desk, you have access to MYGA’s (Multi-Year Guaranteed Annuities) from A-rated carriers. Guaranteed periods range from 2 to 10 years, and offer much higher yields than they are getting now. While these products are not FDIC insured, they are backed by the financial strength of each carrier, in addition to the Texas Guarantee Fund up to $250,000. Please call us to discuss details.

Which Approach to Long-Term Care is Best for Your Client?

As healthcare improves and people are living longer into retirement, the issue of long-term care has become an increasingly important consideration. Many of us cannot pay for the cost of this type of care “out-of-pocket” and choose to partner with an insurance company to transfer either all or part of the risk.

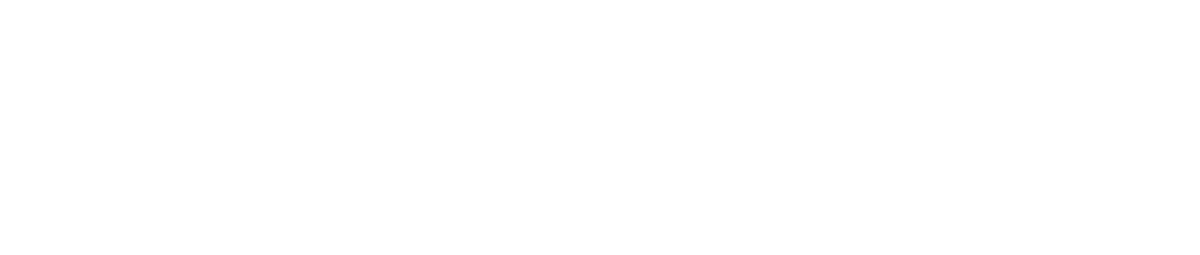

There are three solutions that you can offer your clients – “Traditional” Long-Term Care Insurance, “Asset-Based” Long-Term Care Insurance, and Permanent (Universal, Indexed Universal) Life Insurance with Chronic Illness Riders.

The following chart compares features/benefits of each of these solutions:

All clients are different with respect to their financial situation and the experiences they have had with friends and family when it comes to this issue. You have access to A-rated carriers in each product line mentioned above as well as the support to help you choose the best solution for your clients.

Michael P. Kelly, President

Life Policy Pros, Inc.

502 Monmouth Avenue

Spring Lake, NJ 07762

609-238-9391

Scott Woodruff, Executive Vice President

Life Policy Pros, Inc.

18500 Rio Chama Lane

Austin, TX 78738

512-788-1402