Marketing Corner

Simplicity’s proprietary software is now available

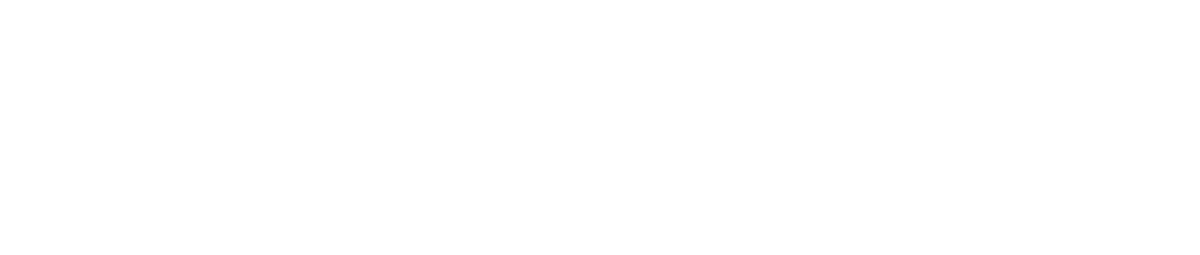

The software focuses on permanent life insurance, comparing leading policies for maximum death benefit per premium dollar, maximum cash accumulation, and/or maximum income, all on one page. It produces visually pleasing, professional presentations on such topics as wealth transfer and IRA rescue, comparing outside investment alternatives.

The software is very easy to use, and simplifies concepts for your clients, making it easier to understand a normally complex topic. The simple presentation created by the software makes selling this way much easier than using an illustration, however the illustrations will be there for you to access at any time.

What’s New?

One of our carriers will write their Accumulation IUL, Protection IUL and Protection UL on clients up to age 90! (If Standard or better)

Some of our carriers offer Return of Premium Riders on permanent products!

Many of our carriers offer High Early Liquidity Riders on their permanent products. Common when using Premium Financing. Spread comp would be involved.

Did You Know?

IUL crediting rates (including caps and participation rates) are linked to debt market interest rates. When prevailing interest rates are low, caps decrease. When interest rates are higher, caps will increase. The goal of an IUL is not to match the performance of a stock market index. The goal is to earn a premium over the debt market return. The insurance company buys and sells call options on various market indices, with the goal of capturing as much movement as they can get with the money they have to spend. The strike prices of the options determine the Cap rates. While this is complicated, it’s not necessary to understand the details; just the idea that if a client can get a good interest rate on a CD let’s say, he or she could potentially do better in an IUL, because the upside (cap) on the indexes offered will increase as well.

Annuity Rate Watch

While MYGA rates continue to inch up, and are great for conservative clients who want a guaranteed return, there are many choices in the Fixed Indexed Annuity market that could be a better fit for certain clients. Some of these products offer income riders, and some are designed for maximum growth. Some also have immediate bonuses, as high as 15%!

If you have a client with an older annuity, it is possible that you might be able to exchange or transfer their funds into a product that has features that may better suit their current/future needs. There are rules to follow in this situation, as it must always be in the client’s best interest. Let us know if you have clients with money sitting in low yielding products and/or have an existing annuity that may be getting “long in the tooth”. We have an excellent annuity desk to help us through all situations!

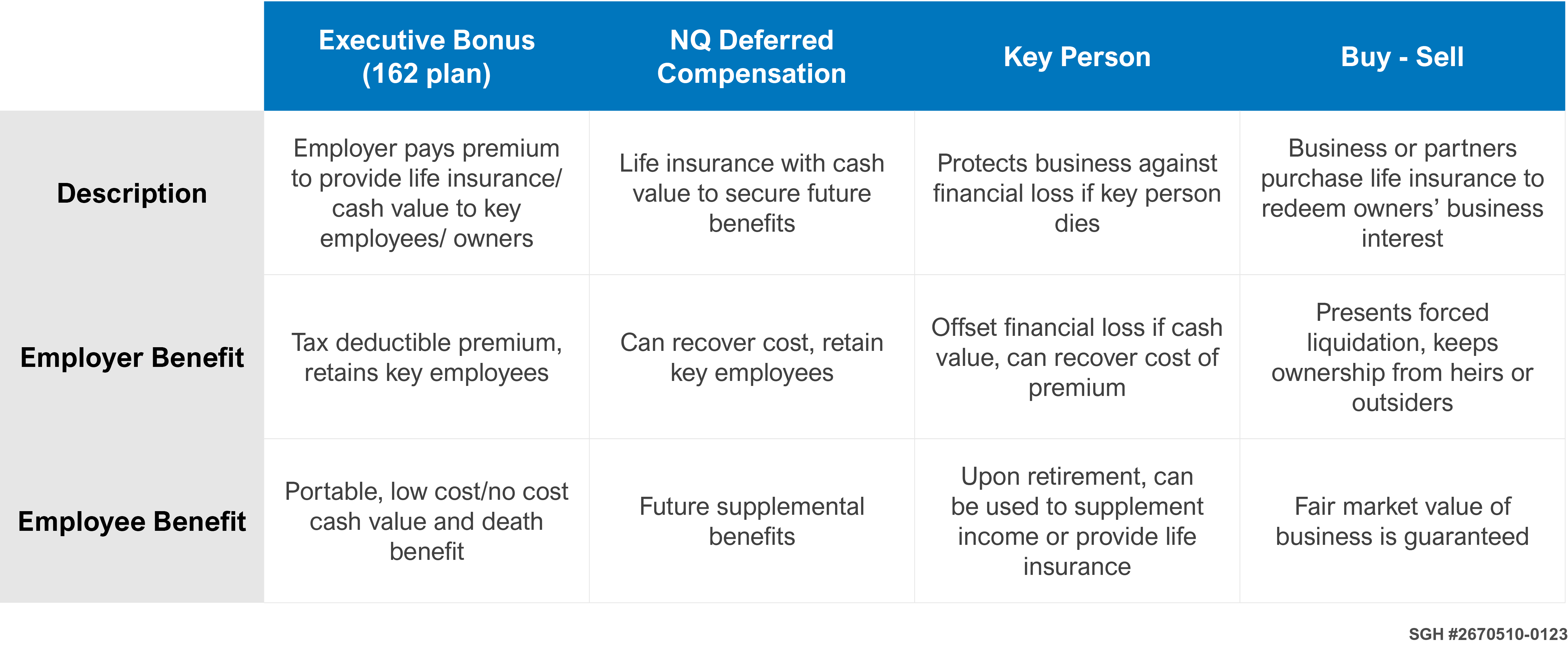

Business Uses of Life Insurance

Many of you have business owners and/or businesses as clients. Life Insurance can be an integral part of planning for these “high-end” relationships.

Our research has shown that, in general, our advisors are not taking full advantage of these trusted relationships and addressing this often overlooked area of mutually beneficial planning. This is mainly due to wanting to stay focused in your area of expertise.

Through our partnership, you now have access to Life Policy Pros’ extensive planning and sales expertise, Simplicity’s marketing, sales and underwriting experience and our carrier partners’ premium products and sales tools.

You do not need to be an “expert” in this area, because we are, and we can run cases for you from A to Z.

The following is a chart summarizing examples of common uses of life insurance in the business market. The chart is very general. We have business fact-finders and sheets on these topics that are client approved, along with sample marketing letters/emails.

Why not take action? Think of clients who may benefit from this type of planning and call us to discuss. Don’t leave additional revenue on the table and allow other advisors in when you don’t have to. Keep doing what you’re good at, and let us help your clients even more.

Michael P. Kelly, President

info@lifepolicypros.org

609-238-9391

Scott Woodruff, Senior ADC

s.woodruff@lifepolicypros.org

512-788-1402

This newsletter is being provided as a service to you. Please note that the information and opinions included are provided by third parties and have been obtained from sources believed to be reliable. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation.

Sources used:

1. Forbes