Marketing Corner

Simplicity’s proprietary software is now available

The software focuses on permanent life insurance, comparing leading policies for maximum death benefit per premium dollar, maximum cash accumulation, and/or maximum income, all on one page. It produces visually pleasing, professional presentations on such topics as wealth transfer and IRA rescue, comparing outside investment alternatives.

The software is very easy to use, and simplifies concepts for your clients, making it easier to understand a normally complex topic. The simple presentation created by the software makes selling this way much easier than using an illustration, however the illustrations will be there for you to access at any time.

What’s New?

Many carriers have lifted COVID restrictions

Fixed Annuity/MYGA rates have increased significantly recently

Caps and Participation rates on IUL’s have increased as interest rates have

Did You Know?

We have an excellent underwriting department that can help to find the best carrier(s) for your “difficult to place” cases. We can find the best carriers with respect to issues such as diabetes, cancer, build, non-cigarette tobacco (vaping, cigars) and marijuana. Don’t automatically assume someone is uninsurable. You’d be surprised at what we might find for you!

Annuity Rate Watch

Fixed annuity rates have increased significantly

Many of your clients have money sitting in historically low yielding CD’s and savings accounts. Through our Annuity Desk, you have access to MYGA’s (Multi-Year Guaranteed Annuities) from A-rated carriers. Guaranteed periods range from 2 to 10 years, and offer much higher yields than they are getting now. While these products are not FDIC insured, they are backed by the financial strength of each carrier, in addition to the Texas Guarantee Fund up to $250,000. Please call us to discuss details.

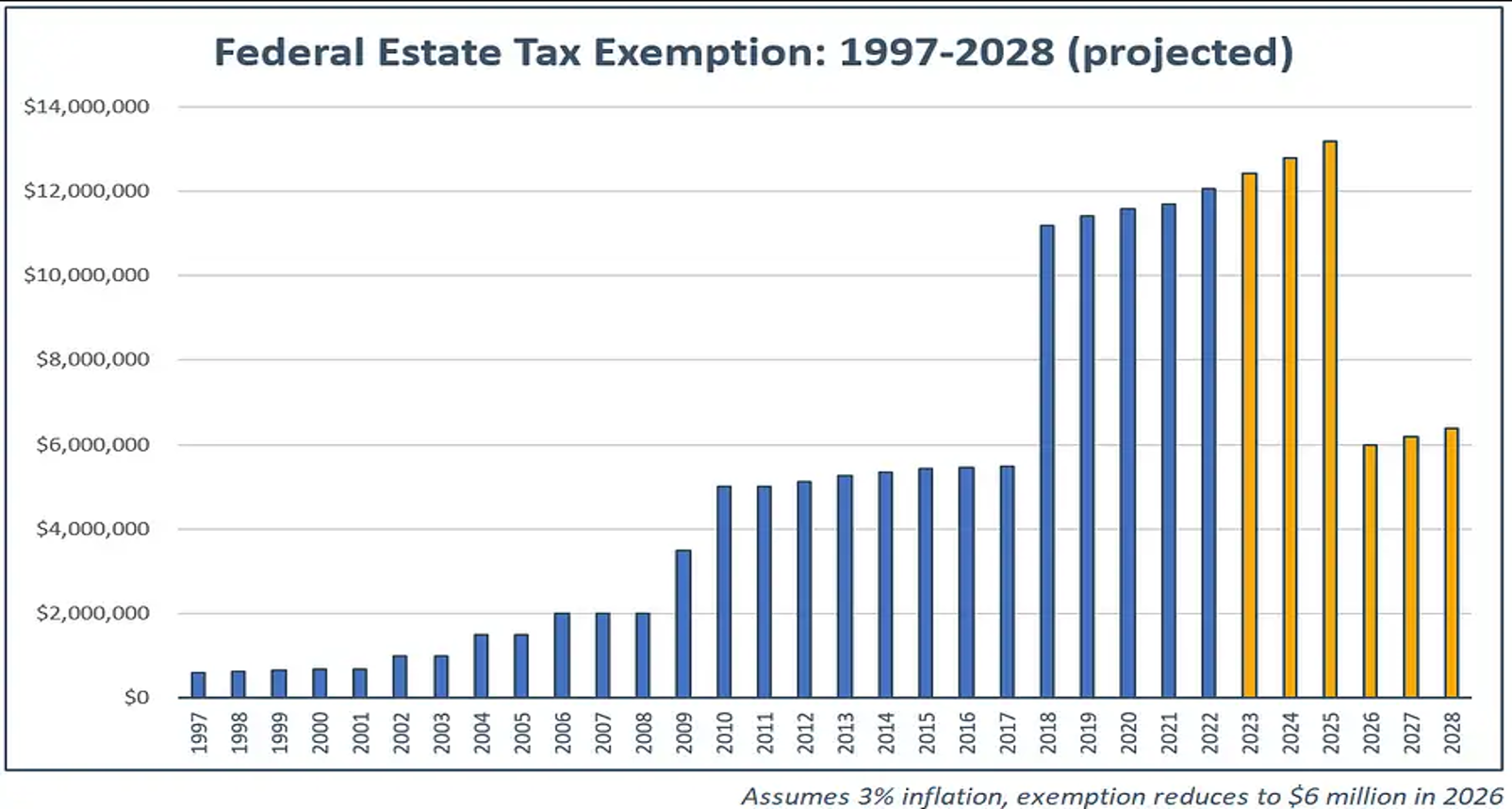

Estate Planning Changes Your Client Needs to Know1

The Internal Revenue Service recently announced new inflation-adjusted limits for 2023 that will allow well-off folks to transfer much more to their heirs’, tax free, during life—or at death. One key gifting change is to the annual exclusion: your clients will be able to give anyone else (and as many people as they want) $17,000 in gifts in 2023, without worrying about using up their lifetime gift and estate tax exclusion or paying gift tax. That’s up from $16,000 in 2022. The other big change: the lifetime estate and gift tax exemption (also known as the unified credit), will jump to $12.92 million in 2023, up from $12.06 million in 2022. Since couples share their exemptions, it means a wealthy couple that starts making gifts in 2023 can pass on $25.84 million. Another way to look at it: if they have already maxed out their nontaxable gifts, they can give an extra $1.72 million to their heirs in 2023. That’s in addition to making $34,000 per couple (two times $17,000) in annual gifts to each child, grandchild, sister, brother, niece, nephew, neighbor, or friend they’re feeling generous towards. In addition to making annual $17,000 gifts, you can also pay unlimited amounts for anyone’s tuition or medical expenses, without eating into your lifetime exemption, so long as you make those payments directly to the school or medical provider. The estate tax is assessed at a 40% rate for the largest estates, but the $12.92 million per-person lifetime exemption is only a starting point for the very rich when it comes to wealth transfer. A variety of planning techniques can be used to leverage that exemption. Note that unless you’re ready to part with assets during your life, that new $12.92 million exemption number is not guaranteed. Under the 2017 Tax Cuts and Jobs Act, that lifetime exemption will fall by more than half at the start of 2026. At the end of 2025 the sunset provision of the tax law will reduce the lifetime exemption to $6,000,000. There is discussion about it being indexed for inflation and that could go to 7,000,000+. However, given the current deficit and the appetite for taxes in Washington, this number could be as low as 3 to 3 1/2 million. When January 1, 2026, arrives, not if, some of your clients may have drastically different estate tax exposure than they do today. Think ahead and plan ahead! People don’t plan to fail; they fail to plan. What are the action steps for advisors today? Number one, identify your clients who have a net worth currently in excess of $5 million. Especially those with large, qualified plans, because those clients have beneficiaries that will be taxed as ordinary income on their qualified plan inheritance and the entire qualified plan will also be subject to 40% of estate tax. For some beneficiaries that could be between a 70% and 80% total tax rate as a beneficiary of a qualified plan. Number two, have the courage to have these difficult conversations. When the tax bill is due the beneficiaries always look for the path of least resistance, that is to liquidate assets that investment advisors are managing. Stocks and bonds may be sold before real estate. Don’t let this affect your AUM. And lastly, work with a good advisory team. It’s free to have a good conversation and it may save your clients and their beneficiaries millions of dollars at the same time preserving your valuable book of business.

Michael P. Kelly, President

info@lifepolicypros.org

609-238-9391

Scott Woodruff, Executive Vice President

s.woodruff@lifepolicypros.org

512-788-1402

This newsletter is being provided as a service to you. Please note that the information and opinions included are provided by third parties and have been obtained from sources believed to be reliable. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation.

Sources used:

1. Forbes